Finally, after bidding for two days, we got our room at DC. It is 4* Convention CTR Renaissance. We got it for $135 per night ($158 after tax). Looks like everything requires a little bit persistent. :)

Wednesday, April 30, 2008

Update On the Hotel Bidding Process

Posted by LazyInvestor at Wednesday, April 30, 2008 0 comments

Labels: ShoppingSmart

I signed up for PPP!

I am excited because, finally, PayPerPost approved my blog to their blog network . If you do not know what PayPerPost is, don't worry. You are probably not alone. PayPerPost is a great company who allows you to get paid while posting on your own blogs. I really see its service as a win-win situation. Bloggers help the advertisers to spread out the words about their products or services. In return, the advertiser will pay you for helping promoting them.

I first knew about PayPerPost from Krystalatwork blog. The story between Krystalatwork and PayPerPost is quite inspiring. Within one year, Krstalatwork has made around $2000 from it. That makes me realized that it is possible to make money while doing something you like.

I think there are some benefits to join PayPerPost. One, obviously, you can generate some income while doing something you have already been doing. Secondly, let's get realistic, sometimes, you just could not find a topic to post. This is when the PayPerPost can help as well. It helps you to find a topic to write on your blog when your ideas dry out. Thirdly, you can find a lot of fellow bloggers on PayPerPost, browse their sites, make friends. Last, not the least, there are many companies who advertise through PayPerPost. You will consistently get to know new products/services on PayPerPost.

I am on a personal project to generate some alternative income. I am sure PayPerPost will be a great choice helping me achieving my goal.

Posted by LazyInvestor at Wednesday, April 30, 2008 0 comments

Labels: Sponsored Post

No Success for Hotel Bidding on Priceline so far

Three of my friends and I are planning a trip to DC for this May Long Weekend. The process of booking flight tickets went flawlessly. We booked the tickets through Priceline for $178 per person, round trip, including tax and fees. With the rebate of $14 from GreatCanadianRebates, the deal is even sweeter.

Now we need to book the hotels for our stay in DC. This has been extremely difficult. I have been bidding up to $110 on Priceline for 4-star hotel in Downtown area without success. People seems to be able to get the same level hotel in the same area for not more than $100 outside the long weekend week. There must be something going on in DC, such as conference, etc. I just don't know what! Well, I have to keep on bidding tonight. Wish me luck! :)

Posted by LazyInvestor at Wednesday, April 30, 2008 0 comments

Labels: ShoppingSmart

Tuesday, April 29, 2008

$550 Away From $50,000 in NetWorth

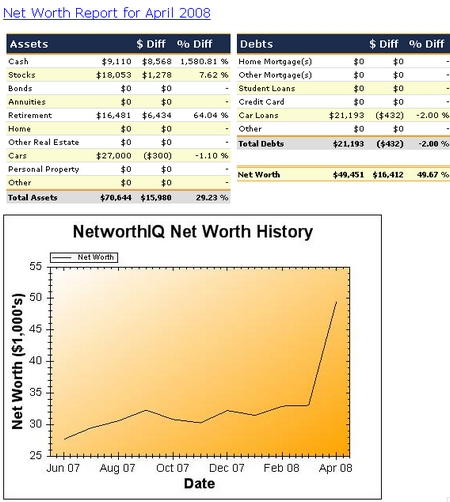

Did you see the chart? Did you see the chart? My net worth chart on the right. It did jump!

I have been eager to update my net worth for this month. With the tax refund and the pension statement I just got from my employer, I should see a big jump on my net worth. And it did! I am so happy to see my net worth jump into the $40,000 level and almost hitting the $50,000, only $550 to go. $550 is not a big number to achieve I think. I should be able to get into that level next month! :D

Posted by LazyInvestor at Tuesday, April 29, 2008 2 comments

Labels: Net Worth

Sunday, April 27, 2008

My Pension Statement

I got my pension statement from my employer in the mail this Friday. According to the statement, after two years service, I have accumulated $6094 in my pension including my contribution, my employer's contribution and any investment earnings.

To my surprise, despite the sub-prime crisis in the stock market, my pension still generated a 3.3% investment return over 2007. After I looked more closely at the statement, I think I found the reason.

The pension fund has been divided into four parts. 45% of the fund has been invested in the Bond fund(38% in CIBC Cdn Bond Core;another 7% in PH&N Cdn Bond Core);10% in International market(Putnam EAFE Equity);31% in Canadian Equity(Jarislowsky Fraser Cdn Equity);and the last 14% in US Equity(Northwater US Equity). I think the heavy weight, 45%, on the bond market has been the major reason for the 3.3% return over 2007.

The investment style for my pension has been very conservative considering 45% of it is in Bond. I am not sure what the average age in my company is. If it is around 45-50 years old, I will certainly understand the assets allocation. When it comes to invest for pension, security of the money is more important than the possible return,especially when my company is still offering the DB Guarantee. The company does not want to get into the situation when it could not afford to support people's retirement. For individuals, if you have a lot of pension, you might want to see how it will affect your overall assets allocation for your portfolio and adjust accordingly.

Posted by LazyInvestor at Sunday, April 27, 2008 0 comments

Labels: Miscellaneous

Saturday, April 26, 2008

Eager to Update My Networth

I want to write a post about my net worth update so much for this month. With the tax refund and the pension statement I just got from my employer, I should see a big jump on my net worth. I usually do the net worth update the day after I pay my car loan each month, which is around 2 days from now. Stay tune!

Posted by LazyInvestor at Saturday, April 26, 2008 0 comments

Labels: Net Worth

Friday, April 25, 2008

A Different Approach to My RRSP

The way I contributed to my RRSP has always been putting the money I got from my tax refund into my RRSP account all and at once. After I did it, I do not need to worry about my RRSP for a whole year. That worked fine when the money has been put into savings or GICs, but not a great strategy for buying mutual funds inside RRSP. This year I want to take a different approach.

For the tax refund I am getting, I will save it under my regular savings account until it hit the amount of $10,000. When I have $10,000, I will transfer the money into my Questrade account and balance my ETF holdings there. In terms of my RRSP, I have just called my mutual fund associate to set up a monthly contribution of $400. By the end of the year, I will have my RRSP being taken care of as well.

The major benefits of this approach are:

1. Dollar Cost Averaging for my RRSP mutual fund purchase. The stock market turbulence has shrunk many investors networth. I am not the exception. However, the Scotia Dividend Fund I purchased right before the stock market sink is still in green. How is it possible? Because I am doing dollar cost averaging and continue to buy it each month. I would certainly like to apply this technique and take advantage of it for my RRSP account as well.

2. Keep my ETFs transaction cost down. By saving the tax refund I got and investing it into my ETF portfolio when the amount hits $10,000 allows me to keep my total trading cost under 1% of the money added.

3. Mostly importantly, I will be saving $400 more per month instead of blowing it away by taking this new approach to my RRSP.

Have a great weekend! :)

Posted by LazyInvestor at Friday, April 25, 2008 0 comments

Labels: Investment

Wednesday, April 23, 2008

Two Coffees a day keep vacations away

We have a Tim Horton's by our office building with a walking distance less than 500 meters. Everyday, sure enough, many people will go there and buy a cup of coffee even if we have free one in the office. I want to do a calculation to see how much two coffees a day is going to cost us.

Let's say we buy two medium double double a day, one in the morning, one in the afternoon. I think the price for each one is $1.39. We work 5 days a week. There are 52 work weeks in a year.So, we spend $1.39*2*5*52=$722.8 a year for two coffees a day. Let's say you put the $722 into a GIC or other investment vehicle earning moderate 5% return each year. At the end of year2, assuming your marginal tax rate is 40%, you will have $1465.68 in your pocket, after tax.

How much it costs to fly back to China? I think it is around the same figure. What about vacations within North America? The trip I am going to take to Orlando will cost me less than $900, keeping in mind that we won't go cheap for the trip and will stay in a four star hotel. So the message is clear. You never think two coffees a day will keep your vacation away, don't you?

But don't get me wrong. I don't believe in dying loaded. Life is about to enjoy it as much as you can. I mean, if the coffee from Tim Horton's is so much difference from the free coffee offered in the office and will make you so much happier, by all means, go to Tim's and buy yourself a nice cup of double double. If not, why don't you save two coffees a day. When next time, people wonder how you can afford to go back to China every other year or going on vacation each year, you can say out loud and proudly, "I am paying for that with my coffee money." I guarantee you the satisfaction level will be so much higher than two coffees a day.

Posted by LazyInvestor at Wednesday, April 23, 2008 0 comments

Labels: Miscellaneous

Tuesday, April 22, 2008

Skype Unlimited Calling

Skype is introducing new monthly subscription to its unlimited calling. There are three plans, $2.95/month for unlimited US&Canada, $5.95/month for unlimited Mexico, and $9.95/month for unlimited World. All plans include voice mail and Skype To Go (unfortunately, not available in Canada).

In terms of call quality, based on my previous experience, it is not superior, but acceptable. As I call overseas very frequently to my family and friends, I think I will try the unlimited world.(Skype is having Save 1/3 when you buy a 3 or 12 month subscription promotion until June 1st as well).

You can find more information here.

Posted by LazyInvestor at Tuesday, April 22, 2008 0 comments

Labels: ShoppingSmart

Monday, April 21, 2008

Book Review: The Wealthy Barber

I just finished reading this all-time Canadian bestseller, The Wealthy Barber,which I bought from Chapters around two weeks ago. I could not believe how fast I finished reading this book. It only took me two weeks to finish all ten chapters. I remember that sometimes I need more than a hour to just flip one page of the text books. With this book, I simply have problems putting it down.

The Wealthy Barber covers many financial planning topics, including Investment, Wills, Life Insurance, RRSP, Mortgage, and Income Tax. It is very understandable and entertaining financial planning book. It explains everything without intimidating charts and graphs and a series of lifeless numbers. After reading this book, you will find out a good financial planning is nothing but common sense.

I would like to quote some words from the book, which I think either very useful or entertaining.

In the chapters talking about basic financial planning, it says:

“Wealth beyond your wildest dreams is possible if you learn the golden secret: Invest ten percent of all you make for long-term growth” Now you know the famous ten percent rule. ![]()

Ever wondering why your personal budget never works while business budget always do? See below:

“a business only has to budget for needs. It’s in the best interest of the business to limit those needs as much as possible. An individual, on the other hand, must budget for both needs and wants. It is a rare person who can do that successfully because, for too many people, a want becomes a need”

Afraid of risk when investing and would rather to have all your money sitting in your bank account earning interest? The wealthy barber says:

“Be an owner not a loaner over the long run.If it were consistently more profitable for businesses and individuals to leave their money in the bank than to invest it in North American enterprises, we’d all be in big trouble.”

I could not help laughing when I read the following:

” A broker is someone who invests your money until it’s his.” Haha, I feel the financial advisor is no difference. So be your own financial advisor because nobody cares about your money more than you do.

Wants to time the market and think somebody might have the forecast power?

“As for consistently accurate short-term forecasts, there is no such animal”; “Patience is always one of the most valuable attributes in investing.”

What about real estates?

“With real estate, it’s a matter of timing. There is no dollar cost averaging here.” Know nothing about dollar cost averaging? You need to pick up the book right now.

So if you know nothing about ten-percent rule, dollar cost averaging, when and how much life insurance you need, how to use income split technique to lower your tax bill, so on and so forth, you need to read this book. You will be glad you did.

Posted by LazyInvestor at Monday, April 21, 2008 0 comments

Labels: Book Review

Sunday, April 20, 2008

ING STREET WISE FUND

It has been more than three months since ING Direct Canada introduced its new and first Index fund series (it is actually a fund of index funds), ING StreetWise Fund. I have been thinking if I should put some money into it every month as my investment outside RRSP.

After I did some more in-depth study of the fund, I think it is NOT a good idea to hold it as an investment outside RRSP. One simple reason is that the StreetWise Fund will be balanced every quarter to maintain its original assets allocation. In order to be rebalanced, this wrapped fund will have to sell one or more index funds within it. That will force the investor to realize some unnecessary capital gains. Hence, there will be more tax payable at the end of the year.

If you know how to buy ETFs and rebalance them once a year, it will be better to go with the ETFs route. It is cheaper and more tax efficient.

Just my 2cents.

Posted by LazyInvestor at Sunday, April 20, 2008 0 comments

Labels: Investment

Saturday, April 19, 2008

More on TFSA, TFSA vs. RRSP

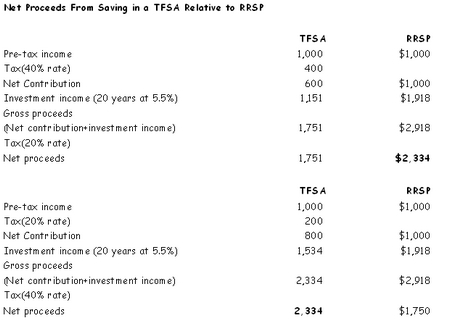

So now, we have the TFSA. Compared with RRSP, which one is more favorable depends on a lot of factors including your marginal and average tax rate, the pension you will receive when you retire, if you are going to use this money to buy your first home, etc. Let's look at one of the most important factor, your tax rate, for this comparison first. The following tables show you three scenario:

a) you have the same tax rate when you contribute to your TFSA or RRSP as when you withdraw money from then. As you can see in the table, the overall return from TFSA and RRSP is the same.

Reference: http://www.budget.gc.ca/2008/plan/ann4a-eng.asp#personal

b) & c) If you have higher tax rate when you contribute to your TFSA/RRSP than the time when you withdraw money from the account, you are better off to contribute the money into RRSP first. On the opposite side, it will be better for you to contribute into TFSA rather than RRSP.

If we look at the tax rate alone, the answer seems to be very simple. If your tax rate is going to be lower than the time you contributed into this type of account, RRSP is better. Otherwise, TFSA is better. If you expect to be in the same tax rate for your whole life, then it does not matter to contribute into RRSP or TFSA.

However, it is not THAT simple. There are still many other factors might affect the decision. For example, even if you are going to have the same tax rate for your whole life, the RRSP will still be better for the first $20,000 if you are ever going to buy a house since you can withdraw it tax free from RRSP account. If not, it looks like they are equally good. But since Income earned inside the account and withdrawals from the account WILL NOT affect eligibility for federal income-tested benefits and credits(Income from RRSP does), TFSA is actually better since you will not affect the CPP, OAS benefits that you might receive from the government.

Scenario c) actually makes me wonder for the people who save a lot, there must be a point when contribute into TFSA is better than into RRSP. I have not quite figured out what that point is yet.

Posted by LazyInvestor at Saturday, April 19, 2008 0 comments

Labels: Tax

Thursday, April 17, 2008

K.I.S.S

Will you live in the log style home as follows for 7 days a week? Personally, I don’t mind live in such a house for maybe one week. Anytime longer than that, I cannot deal with. Nevertheless, this is a house with a very different style, personality and characteristics. However, it is a style more suitable for a cottage rather than a regular HOME. The possible market size for this kind of home is very small due to its unique style. It explains why the house has been on the market for around 2 years with 20% price reduce from its original asking price and yet to be sold.

When you build/buy your house, if you might want to sell it in the future, try to neutralize it as much as possible. “Keep it simple and stupid” has its root in real estate invesment as well.

Posted by LazyInvestor at Thursday, April 17, 2008 0 comments

Labels: Miscellaneous

Monday, April 14, 2008

Tax, Done!

Finally, I got the T3 from Questrade yesterday. I could not wait to enter all the information in Studio Tax and netfile my tax right away. It looks like I am going to get round $8000 in tax refund this year! Sweet!

Posted by LazyInvestor at Monday, April 14, 2008 0 comments

Labels: Tax

Tuesday, April 8, 2008

Tracking Networth with NetworthIQ

I have been using NetworthIQ to track my networth for a while. Besides the fact that you can easily see where your networth is heading to by using it, there is another feature that I really like. I can run various comparison reports with NetworhIQ.

After updating my networth this month, I wanted to see where I am standing now. So I ran following comparison reports and discovered some interesting trends.

1. Networth Comparison Report

As you can see you can compare yourself among the people who have the same age, income, occupation, education as you do. I usually look at the median value in my age and income group since it will reflect how I am doing more clearly and correctly. Average value tends to be more skew. There might be some persons born with a silver spoon and drag the average networth ridicularly high in my age and income group. Also, I don’t look at the networth data in my occupation and education group since I don’t want to compare myself with a people with 10 more years experiences than me. They will and should be having more networth than me. Right?

So how am I doing in terms of networth? In my income group, I am doing pretty well and my networht is above the median value of $13,919, which means I have been well ahead of 50% of the people in my income group. And for the first time, I am almost there for the median value of $33,100 in my age group, just $61 short. I hope I will exceed the median networth of my age group next month!

2. Home Ownership

Interesting enough, it looks like in my age and income group nobody is owning a home or having a home mortgage now. Hum…….

3. Credit Card Debt

Wee~~~, I don’t have any credit card debt at all,which is a very good thing, while the median number of the debt is $800 and $700 for my age and income group.

4. Cash

I am well behind in this category. As I am building up my emergency fund now, I expect to see the situation got changed next month. The target for my emergency fund is $5000.

There are more reports you can check out in NetworthIQ other than those four mentioned above. Although the number will not be 100% correct and perfect, it is still nice to see where you are standing, well, roughly.

Posted by LazyInvestor at Tuesday, April 08, 2008 0 comments

Labels: Miscellaneous