I have finally got all my tax refund back yesterday, both Federal and Provincial. Some people might have argued that tax refund is a really bad thing because you basically give the government a free loan for a year. However, I prefer to receive a tax refund at the end of the year than getting it each month.

Spending habit is hard to adjust when you are trying to go from extravagance to thrift. At least it is a very painful process. Having the tax refund at the end of the year actually works as a forced saving. If I receive the tax deducted each month from my pay cheque, I might just allow myself to spend more rather than save the money.

Also, receiving a big sum of the money at the end of the year allows me to better utilize it. I can either put them into my mutual fund, ETFs, Stocks or Cash component based on my overall assets allocation.

What is your preference? A big sum of money at the end or a little bit each month? No matter what your preference is, saving it is the key! :)

Tuesday, June 3, 2008

Is Tax Refund Good or Bad?

Posted by LazyInvestor at Tuesday, June 03, 2008 1 comments

Labels: Miscellaneous, Tax

Thursday, May 8, 2008

Pay Attention to Your Withholding Tax

Do you buy stocks which are listed in American Exchange? If you do, you might want to double check the statements from you broker and make sure you have been charged for proper amount of withholding tax.

The withholding tax is the tax to be withheld by the paying country on dividends and interests paid to residents of the other country. Normally, the withholding tax rate is 30%. But because of the agreement between US and Canada, if the security holder (You) has certified himself/herself as a Canadian resident, only 10% and 15% withholding tax rate will apply for the interests and dividends you received from US investments, respectively.

For example, if you, as a Canadian, buy the Bank of America shares listed on New York Stock Exchange, for every dollar dividends you received from BAC, there will be 15 cents tax withheld. When you file your tax at the end of the year, you can claim the credit for foreign tax paid, but up to 15% withholding tax level. And then you includes the grossed-up amount (100% of the interest or dividend payment) on Canadian tax returns, and calculates federal and provincial taxes in the normal way. It is important to make sure you are charged for withholding tax at the maximum 15% level instead of 30%. Otherwise, you will be double taxed.

It goes like this: You paid 30% up front, only able to get back maximumly 15%, file the tax, pay whatever tax you owe on the interest/dividend you received from US investment, say 20% of the interest/dividend, based on your income level. How much you have been tax actually? 35% (30%-15%+20%).

So if you invest in the US securities, it is important that you are taxed properly.

Posted by LazyInvestor at Thursday, May 08, 2008 1 comments

Labels: Investment, Tax

Saturday, April 19, 2008

More on TFSA, TFSA vs. RRSP

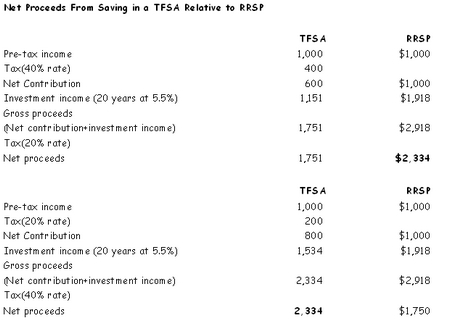

So now, we have the TFSA. Compared with RRSP, which one is more favorable depends on a lot of factors including your marginal and average tax rate, the pension you will receive when you retire, if you are going to use this money to buy your first home, etc. Let's look at one of the most important factor, your tax rate, for this comparison first. The following tables show you three scenario:

a) you have the same tax rate when you contribute to your TFSA or RRSP as when you withdraw money from then. As you can see in the table, the overall return from TFSA and RRSP is the same.

Reference: http://www.budget.gc.ca/2008/plan/ann4a-eng.asp#personal

b) & c) If you have higher tax rate when you contribute to your TFSA/RRSP than the time when you withdraw money from the account, you are better off to contribute the money into RRSP first. On the opposite side, it will be better for you to contribute into TFSA rather than RRSP.

If we look at the tax rate alone, the answer seems to be very simple. If your tax rate is going to be lower than the time you contributed into this type of account, RRSP is better. Otherwise, TFSA is better. If you expect to be in the same tax rate for your whole life, then it does not matter to contribute into RRSP or TFSA.

However, it is not THAT simple. There are still many other factors might affect the decision. For example, even if you are going to have the same tax rate for your whole life, the RRSP will still be better for the first $20,000 if you are ever going to buy a house since you can withdraw it tax free from RRSP account. If not, it looks like they are equally good. But since Income earned inside the account and withdrawals from the account WILL NOT affect eligibility for federal income-tested benefits and credits(Income from RRSP does), TFSA is actually better since you will not affect the CPP, OAS benefits that you might receive from the government.

Scenario c) actually makes me wonder for the people who save a lot, there must be a point when contribute into TFSA is better than into RRSP. I have not quite figured out what that point is yet.

Posted by LazyInvestor at Saturday, April 19, 2008 0 comments

Labels: Tax

Monday, April 14, 2008

Tax, Done!

Finally, I got the T3 from Questrade yesterday. I could not wait to enter all the information in Studio Tax and netfile my tax right away. It looks like I am going to get round $8000 in tax refund this year! Sweet!

Posted by LazyInvestor at Monday, April 14, 2008 0 comments

Labels: Tax

Saturday, March 1, 2008

About tax return, got my T4, still waiting for some forms

It is tax time! Got my T4 from my company last Friday. ING Direct has sent me T5 and my RRSP contribution statement back in January. The forms I am still waiting for are:

1. T5/T3 from Scotiabank. I have less than $50 interest from my MoneyMaster Savings account in Scotiabank. So I don’t think they will send me a T5. But I do have mutual fund account with them as well. My fund distributed some capital gains last year. I should get a T3 for that.

2. T5 from ICICI Bank. ah, this Indian bank, I should get a T5 from them for my US$ account. However, I totally do not expect any form sent to me in time from them. The customer service from ICICI is as horrible as it can get. So rather than waiting for the T5 to come, I just calculated the interest income I need to file myself and get over with it. Fortunately, I don’t have any investment or RRSP account with them. They do have high savings rate. But I will recommend to have very simple investment account with them, such as savings and GICs.

3. T3 from Questrade. I don’t know what the deadline is for T3. I think it is sometime in March. I need the T3 to file the dividend paid out by my ETFs.

So after I got all the forms above, I can officially file my tax. As calculated roughly today, I should get back all my tax paid during 2007. ![]()

I do not want to rush the return this year. I want to identify every possible tax deduction/credit available to me although there might not be any more than I have already known. But it never hurts to double check. Now I just hope I can get all those forms as soon as possible. Then I will be a very happy person.

Posted by LazyInvestor at Saturday, March 01, 2008 0 comments

Labels: Tax

Tuesday, February 26, 2008

Tax Free Saving Account

The budget 2008 has been announced today. The following is the highlights:

- Tax exempt saving fund, up to $5,000 annually. No tax on gain, withdraw anytime without penalty.

- 10.2 Billion to pay down debt.

- Maximum RESP time limit extended to 35 years; contribution period extended by 10 years.

- tax break on capital equipment depreciation extended to 2012

- $500-million for investment in public transit.

- A $2-billion fund for infrastructure investment will be made permanent.

- $250-million over five years to help the automotive industry develop more environmentally friendly vehicles.

- $350-million for a Canada Student Grant Program.

- $90-million for older workers hurt by factory closures.

- $300-million to for nuclear energy.

- $330-million over two years to improve access to safe drinking water for First Nations.

- $400-million to encourage provinces to recruit 2,500 police officers.

- $43 million to Communications Security Establishment

- $75 million to Canada Border Services

- Permanent annual increase in military spending of 2% by 2011

- New organization to administrate EI premium.

As you might have noticed, there is a new account type being introduced today. It is called Tax Free Saving Account(TFSA).

What is TFSA?

It stands for Tax Free Saving Account. According to the budge 2008, Starting in 2009, people 18 and older will be able to put up to $5,000 per year in a Tax-Free Savings Account and rack up investment gains without paying taxes at any time, including withdrawal. Any unused contribution room will be carried forward just like your RRSP room. The $5,000 annual contribution limit will be indexed to inflation in $500 increments. Contributions to a spouse's or common-law partner's TFSA will be allowed, and TFSA assets will be transferable to the TFSA of a spouse or common-law partner upon death

What is the benefit of TFSA?

The major benefit of TFSA is that it allows the money you put into it to grow tax free.

Don't we have RRSP to allow my money grow tax free already? What is the difference between them?

The differences are:

- Although the money in RRSP can be withdrawn anytime before actual retirement, you are subject to withholding tax while doing it; the money in TFSA could be withdrawn anytime without any withholding tax with all the gains being tax exempt.

- When you withdraw your money from your RRSP account, your contribution room is forever lost. Withdrawals from TFSA will create contribution room for future savings.

- The money put into RRSP is tax deductible. In other words, you get tax refund from contribution in RRSP. The money you put into TFSA is not tax deductible. Therefore, you use after-tax dollar to fund your TFSA account.

What could be held inside TFSA?

You can hold many investment vehicles inside your TFSA, such as stocks, bonds, GIC, mutual funds, etc. However, please note that since all the capital gains inside TFSA is tax free, it also means any capital loss inside it cannot be claimed to be offset your other capital gains or carried forward. So please think carefully before holding any stocks inside TFSA. Technically, TFSA works the best for the fixed income investment vehicles, such as GIC and bonds.

What works the best to be held inside TFSA?

Like I just said, it works the best for fixed income investments. However, if you think you are a very good trader, you can try to trade stocks inside TFSA. If you make 10% profit, all 10% will be tax free. Also, I am thinking it might be good to hold some nice US DIVIDEND stocks such as Bank of America. Since under regular non-registered account, any dividend from US Stock will be considered as income and is taxed at the full tax rate. I think it will be beneficial to hold those inside TFSA.

It will be another year from the date we can actually contribute to TFSA. I think it will be an interesting topic in the personal finance blog world.

Posted by LazyInvestor at Tuesday, February 26, 2008 0 comments

Labels: Tax