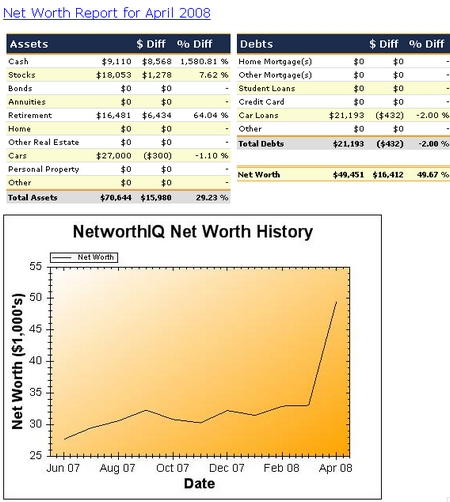

Did you see the chart? Did you see the chart? My net worth chart on the right. It did jump!

I have been eager to update my net worth for this month. With the tax refund and the pension statement I just got from my employer, I should see a big jump on my net worth. And it did! I am so happy to see my net worth jump into the $40,000 level and almost hitting the $50,000, only $550 to go. $550 is not a big number to achieve I think. I should be able to get into that level next month! :D

2 Comments:

Now that's something I hadn't considered doing ... adding my company pension value into my NetworthIQ. Is that a typical thing to do? I mean, I got a company pension statement in the mail a month or two ago ... and if I added in the present value of that, I'm certain my graph would spike up... I just never considered adding that as an "asset", as I consider it something I don't have access to until years in the future.

Likewise, I don't have the car lease listed on the liabilities side ... even though it's an obligatory monthly payment, I don't know how to address it in the net worth, since it's a shared expense with my partner -- I'm actually a co-signor on it.

Any thoughts?

Hi,BAS

I think as long as your pension is vested, it is fine to list it as your assets. Of course, it is locked-in, but, I mean it is still your money, isn't it? There is little difference between RRSP and pension I think. They are both your retirement fund, right?

As for the car lease, because I have car listed as depreciation asset on my networth, I think it is better to list the loan payment as my liability. Thus, I get a better idea how much asset I actually have in my car. ;)

Post a Comment