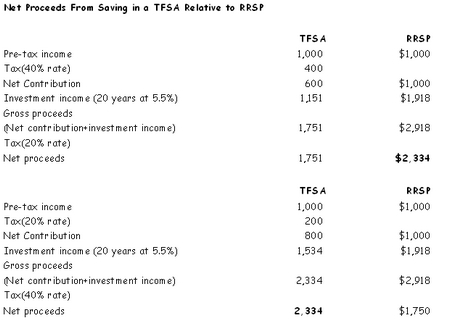

So now, we have the TFSA. Compared with RRSP, which one is more favorable depends on a lot of factors including your marginal and average tax rate, the pension you will receive when you retire, if you are going to use this money to buy your first home, etc. Let's look at one of the most important factor, your tax rate, for this comparison first. The following tables show you three scenario:

a) you have the same tax rate when you contribute to your TFSA or RRSP as when you withdraw money from then. As you can see in the table, the overall return from TFSA and RRSP is the same.

Reference: http://www.budget.gc.ca/2008/plan/ann4a-eng.asp#personal

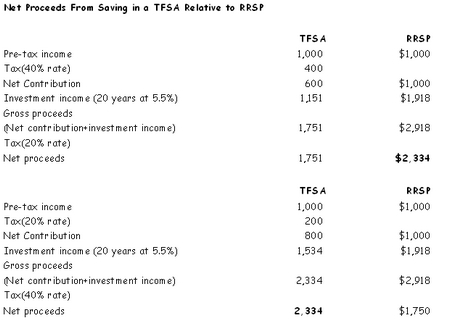

b) & c) If you have higher tax rate when you contribute to your TFSA/RRSP than the time when you withdraw money from the account, you are better off to contribute the money into RRSP first. On the opposite side, it will be better for you to contribute into TFSA rather than RRSP.

If we look at the tax rate alone, the answer seems to be very simple. If your tax rate is going to be lower than the time you contributed into this type of account, RRSP is better. Otherwise, TFSA is better. If you expect to be in the same tax rate for your whole life, then it does not matter to contribute into RRSP or TFSA.

However, it is not THAT simple. There are still many other factors might affect the decision. For example, even if you are going to have the same tax rate for your whole life, the RRSP will still be better for the first $20,000 if you are ever going to buy a house since you can withdraw it tax free from RRSP account. If not, it looks like they are equally good. But since Income earned inside the account and withdrawals from the account WILL NOT affect eligibility for federal income-tested benefits and credits(Income from RRSP does), TFSA is actually better since you will not affect the CPP, OAS benefits that you might receive from the government.

Scenario c) actually makes me wonder for the people who save a lot, there must be a point when contribute into TFSA is better than into RRSP. I have not quite figured out what that point is yet.